O’Reilly members experience live online training, plus books, videos, and digital content from nearly 200 publishers. A prepaid asset appears as a current asset on an organization's balance sheet, assuming that it is expected to be consumed within one year. The concept most commonly applies to administrative activities, such as prepaid rent or prepaid advertising.

#ARE PREPAID EXPENSES AN ASSET HOW TO#

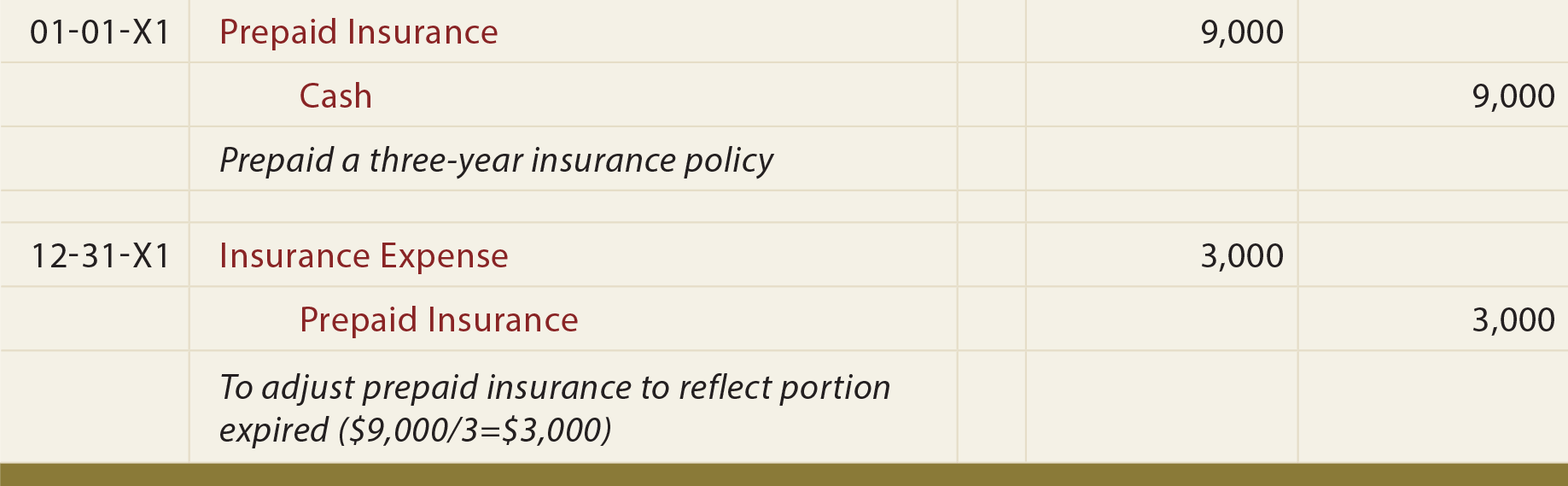

Get How to Read a Financial Report: Wringing Vital Signs Out of the Numbers, 8th Edition now with the O’Reilly learning platform. A prepaid asset is an expense that has already been paid for, but which has not yet been consumed. Annual property taxes may be paid at the start of the tax year these amounts should be allocated over the future months that benefit from the property taxes.Ĭash outlays for prepaid costs are initially recorded not in an expense account but. Another example is office and computer supplies bought in bulk and then gradually used up over several weeks or months. Insurance premiums are paid in advance of the insurance policy period-which usually extends over 6 or 12 months. Insurance premiums are one example of prepaid expenses.

However, the rights to these future benefits or services rarely last more than two or three years. They include items such as prepaid insurance and prepaid rent and essentially represent the right to receive future services. In short, businesses have to prepay some of their expenses. Prepaid assets are nonmonetary assets whose benefits affect more than one accounting period. This chapter, in contrast, explains that certain operating costs are paid before the amounts should be recorded as expenses.

The preceding chapter explains that some operating expenses are recorded before they are paid-by recording a liability for the unpaid expenses. This chapter explains that operating expenses drive this particular asset of a business.ĮXHIBIT 9.1-SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES AND PREPAID EXPENSES Please refer to Exhibit 9.1 at the start of the chapter, which highlights the connection between selling, general, and administrative expenses in the income statement and the prepaid expenses asset account in the balance sheet. CHAPTER 9 OPERATING EXPENSES AND PREPAID EXPENSES Paying Certain Operating Costs before They Are Recorded as Expenses

0 kommentar(er)

0 kommentar(er)